Japan Outlook – The Bank of Japan's year

Key points

- Japan is moving endogenously towards a period of slightly higher inflation, stimulated by rising wages

- Economic growth is likely to slow but it should do well compared to other developed economies and potential growth

- The Bank of Japan has been cautious but yield curve control is all but ending. We expect gradual rate rises starting from the spring, to reach 0.25% by end-2025

Moving beyond fears of deflation?

Japan’s economy appears to be edging towards a turning point. Helped by the global inflation shock brought on by rising energy costs and a weak yen, pricing dynamics are improving. However, while we think it’s unlikely trend inflation will rise to 2% yet, increasing inflation expectations should shift an economy that has battled with deflation for decades. Wages have long been central to the weak domestic inflationary pressures and are showing sustained signs of rising. In 2023, the Shunto trade union confederation spring wage negotiations delivered the largest pay hike in over 20 years (base pay rose by 2.1%). First indications for the upcoming round indicate this could be even higher, as unions have indicated they are likely to ask for total hikes of at least 5% (of which we estimate 3.5% to be base pay).

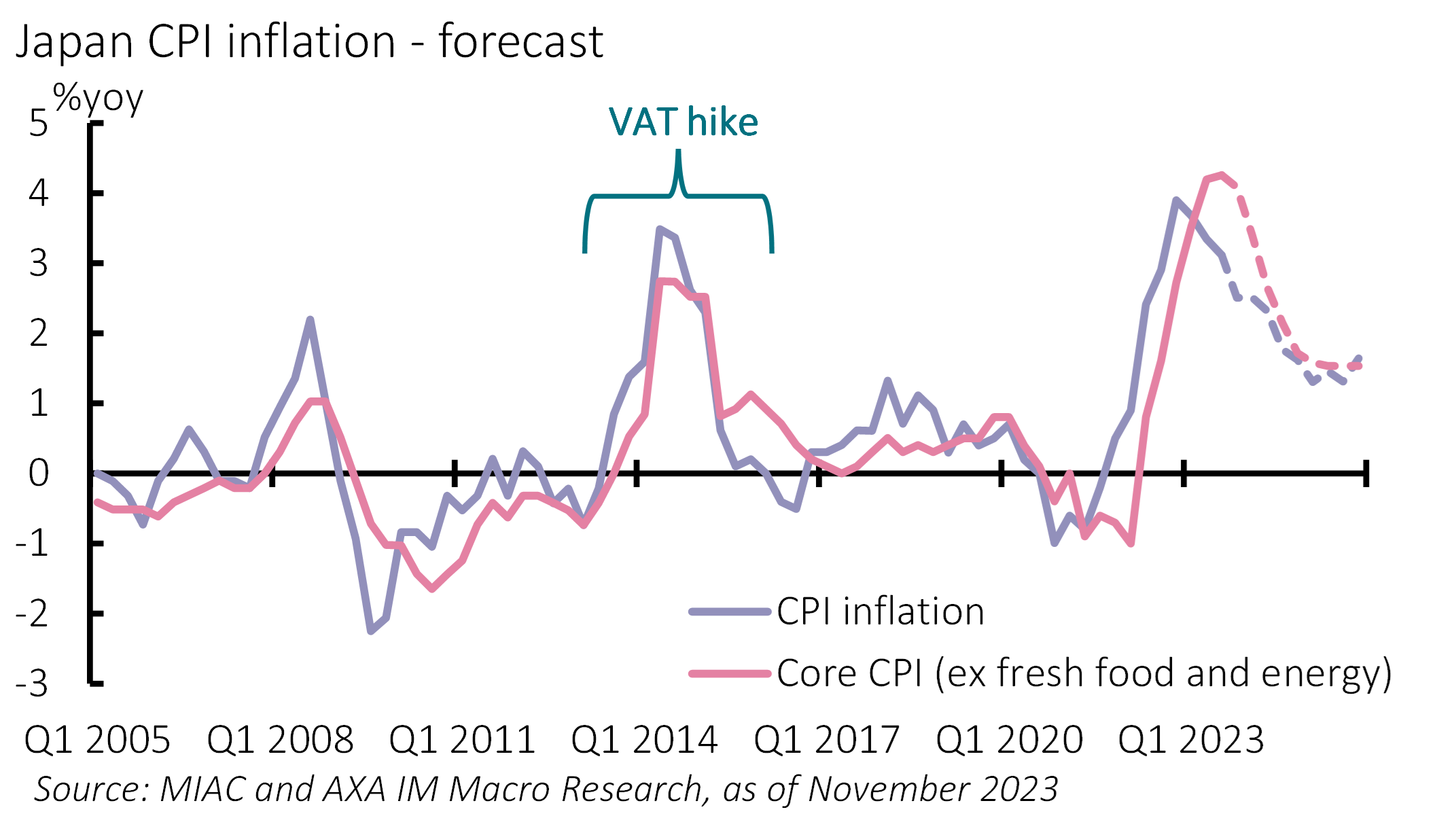

We expect inflation to ease somewhat next year due to base effects though improved wage pressures are likely to see inflation settle above previous levels. We forecast inflation to average 3.2% in 2023, 2.2% in 2024 and 1.6% in 2025 (Exhibit 1).

We expect growth to remain strong, supported by another generous government stimulus package and improving real incomes. We believe the ¥37.4tn package (of which ¥14.3tn is a supplementary budget) should boost GDP by 0.8 percentage points (ppt) and forecast GDP growth of 1.9%, 1.2% and 1.0% in 2023, 2024 and 2025 respectively.

The Bank of Japan (BoJ) has successively loosened its control on 10-year government bond yields (YCC), now seeing the policy’s 1% cap as a soft reference, effectively gutting its policy. We expect the YCC’s formal end to be accompanied by an initial step towards rate policy normalisation with the overnight call rate likely to be hiked by 10 basis points (bp) to 0.0% – ending eight years of negative interest rate policy (NIRP). This is likely around April 2024 in our base case – once the BoJ has better sight of 2024’s spring wages outcome. It should remain prudent, hiking by small steps – 10bps in Q4 and most likely 15bps in the first half of 2025, bringing the policy rate to 0.25% by the end of 2025.

Exhibit 1: Inflation to ease

Road to normalisation fraught with risks

As markets begin to consider what higher rates could look like in Japan, we expect the normalisation path will pose risks for Japan and even the global economy. After years of low interest rates, 60% of Japanese home loans are floating rate. The end of NIRP would not affect the housing market too much if the benchmark short-term prime rate does not change. But if it rises further, payments on existing loans would be affected. While the impact on incomes looks manageable, sentiment and the broader housing market is a risk.

Corporates face a similar issue – firms' funding costs are affected more by short and medium-term interest rates. The impact from an end to NIRP would be felt quickly as higher rates feed through existing floating-rate loans. Again, this should be manageable overall. However, vulnerable corporates and smaller and medium size firms (which includes most of the ‘zombie’ companies) could face another blow. This underscores the high bar for a sustained rate hike cycle by the BoJ.

The government also faces risks from rising rates. Japan’s government debt stands at 263% of GDP – the highest in the G7. The rising cost of servicing its debt is likely to become more burdensome for its already-stretched public finances.

Finally, this expected policy normalisation will also be influenced by the policy cycles in other developed markets. A gradual increase in BoJ rate expectations along with expected easing elsewhere is likely to see yen appreciation, providing headwinds to growth and inflation hitting target.

Risicowaarschuwing

De waarde van beleggingen en de inkomsten die zij genereren, kunnen zowel dalen als stijgen en het is mogelijk dat beleggers het oorspronkelijk belegde bedrag niet terugkrijgen.